What is Gold Tokenization?

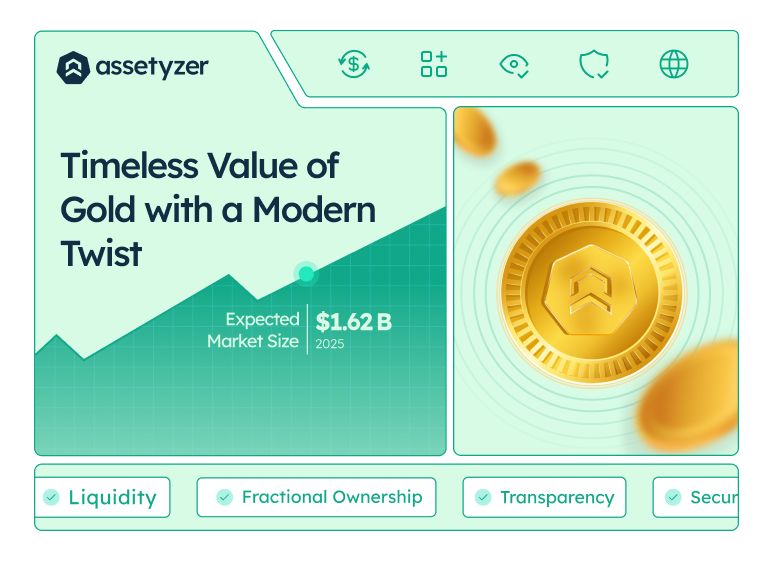

Gold tokenization refers to the process of converting physical gold into digital tokens on a blockchain. Each token represents a specific amount of gold, giving the owner a share in a physical gold reserve.

By utilizing blockchain technology, tokenization makes gold more accessible, liquid, and tradable in a digital format without requiring the investor to physically hold or store the metal.

This innovation offers the best of both worlds: the timeless value of gold, combined with the power of blockchain technology.

Issues that tokenization solves

- Liquidity

Physical gold markets often suffer from illiquidity, especially for small investors.

Tokenized gold can be traded quickly and seamlessly on blockchain platforms, providing 24/7 liquidity similar to other digital assets.

- Fractional Ownership

Purchasing physical gold in smaller denominations can be difficult due to high premiums.

Tokenized gold allows for fractional ownership, enabling investors to buy, hold, or trade smaller portions of gold without needing to purchase entire bars or coins.

- Ownership and Custody

When investing in gold ETFs, investors hold a financial product rather than direct ownership of the physical gold.

Tokenized gold provides actual ownership of the underlying asset, with each token representing a specific weight of physical gold.

- Transparency & Security

Blockchain technology ensures every token transaction is recorded on an immutable ledger, offering investors unparalleled transparency and trust.

The system reduces the risk of fraud, theft, and mismanagement, which can sometimes occur in traditional gold markets.

- Global Accessibility

Gold markets are often localized, making it hard for global investors to participate without incurring significant costs.

Tokenized gold breaks down these barriers, allowing anyone with internet access to invest in gold seamlessly, regardless of location.

3 simple steps to tokenize your real estate

- KYB

To ensure that the entity tokenizing gold and its stakeholders are legitimate. It builds trust among investors and is essential for compliance with legal frameworks.

- Select Real Estate Token Contract

The contract is the backbone of the entire tokenization process. It automates the rules governing ownership, revenue sharing, compliance, and transfers.

- Own & Transfer

When an investor purchases a token, they acquire fractional ownership of the gold represented by that token. The investor can transfer or sell them to another party.

Roadblocks

- Regulatory Uncertainty

Countries are still in the process of defining clear regulations for tokenized commodities like gold.Businesses operating in this space must navigate regulatory ambiguities, which can be time-consuming and costly.

- Trust in Custodianship

For tokenized gold to be effective, the physical gold backing the tokens must be securely stored by trusted custodians.Any failure in custody services or mismanagement of gold reserves can lead to loss of trust among investors.Establishing credible and transparent custody mechanisms is critical for the long-term success of tokenized gold.

- Market Volatility

Tokenized gold prices can still be subject to short-term market volatility, influenced by both the gold market and broader market fluctuations.This price volatility can affect investor confidence, especially among those accustomed to more stable and traditional gold investments.

Technological Evolution in India

India, one of the largest gold consumers in the world, has begun embracing the digital transformation of its gold markets.

Over the last few years, fintech platforms and startups have increasingly experimented with blockchain applications in gold trading.

The vision is to combine traditional gold investment practices with cutting-edge technology, creating a seamless bridge between the physical and digital worlds. This represents a new era where gold investments can cater to the digital needs of younger investors while maintaining the stability and trust that older generations associate with the precious metal.

Conclusion

Gold tokenization is set to revolutionize the way we invest in gold by offering more liquidity, transparency, and flexibility compared to traditional options like gold ETFs.

By solving key issues related to ownership, custody, and accessibility, tokenized gold opens up new opportunities for both individual and institutional investors.

However, to fully realize its potential, challenges such as regulatory uncertainty and technological adoption must be addressed.